This article is a continuation of article - Illustrations - Edit Outcome - 'What If' Scenario

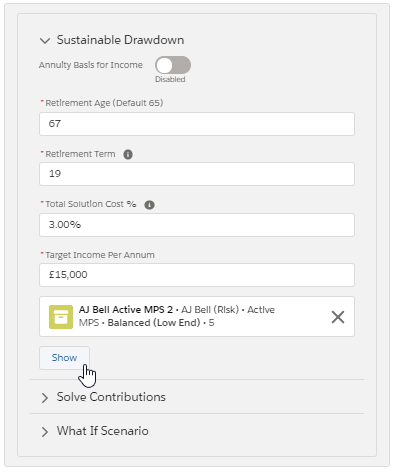

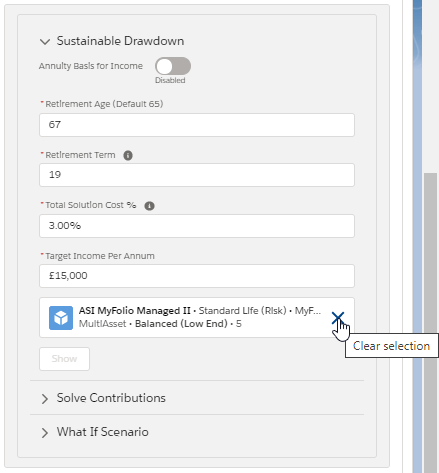

The Sustainable Drawdown filter allows you to see the longevity of the investment, using the following information:

- Retirement Age

- Retirement Term (must be between 1-55 years)

- Total Cost Solution % (percentage charge to be used as the Total Cost Solution)

- Target Income Per Annum

- Portfolio

You can also enable 'Annuity Basis For Income' which will need the following Information:

- Retirement Age

- Target Income Per Annum

In the example below, the client will retire at 67 with 19 years until retirement, It currently costs 3% as a total cost and they plan on taking a £15,000 income per annum.

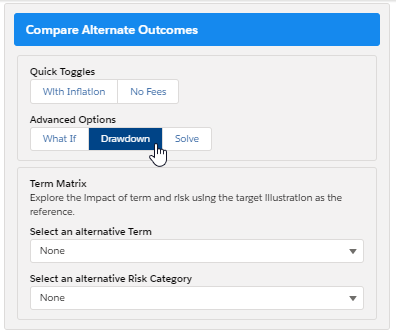

Select 'Drawdown' within the Compare Alternative Outcomes area:

This will open the 'Sustainable Drawdown area on the bottom right of the screen.

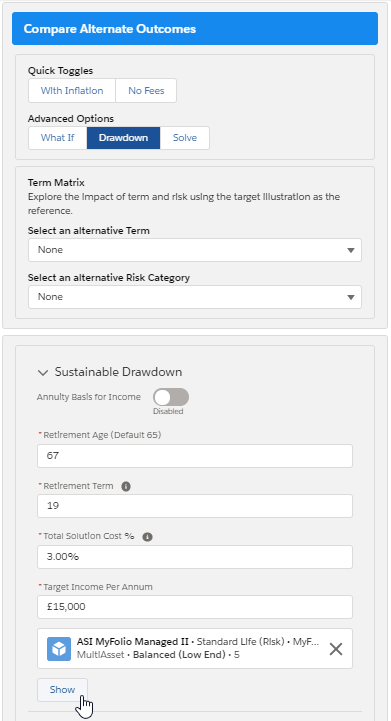

Complete the details and click 'Show' to add to the graphs and alternative outcome summary.

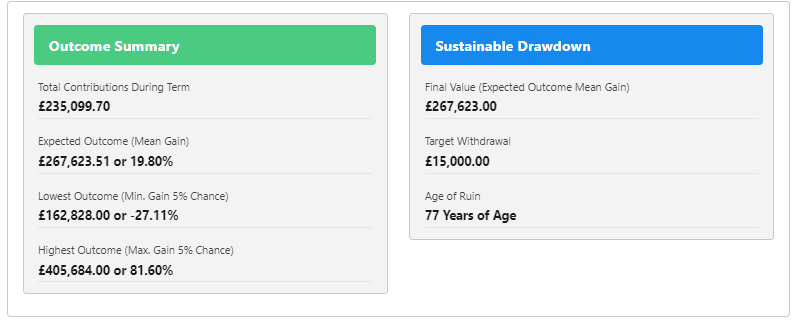

The graph will update to show the gender neutral life expectancy (shown by the black line below). If the fund will deplete before life expectancy, you will see a red 'Age of Ruin' line to indicate when this is likely to happen.

The Sustainable Drawdown area will also populate below the graph to show the Starting Value (Target Outcome Mean. Gain), Target Withdrawal and Age of Ruin.

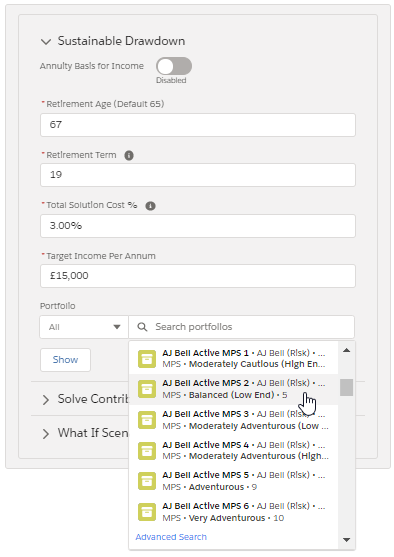

If you would like to select an alternative portfolio, click the cross next to the portfolio and you will be able to search for another portfolio:

Once selected, click 'Show' to update.