The Reduction in yield shows what effect the total charges applicable to a wrapper will have on the projected growth rate and is calculated as

Reduction in yield = projected growth rate – AER (annual effective rate).

For example, if we expect an investment to grow at the projection growth rate of 7% but due to the effect of charges it actually only grows at 5.59% AER then the RIY is 1.41%.

RIY is therefore not just the costs figure, or the sum of the charges, it takes into account the lost growth and shows the effect of the total charges on the projected growth rate.

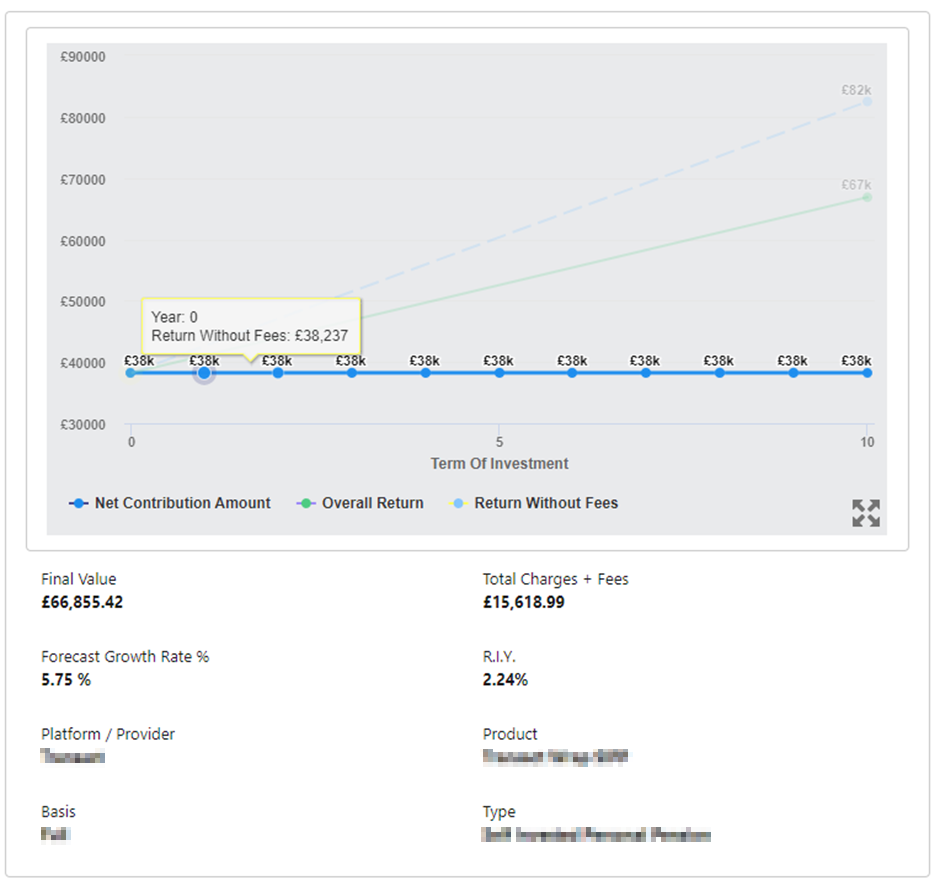

In the example below, if the total investment amount is £38,237.28 with no assets under management then the RIY is 2.24% and the (deterministic) forecast growth rate is 5.75%

If you apply the assets under management (£571,695.00) along with the initial investment (£38,237.28) the RIY falls to 1.96%.

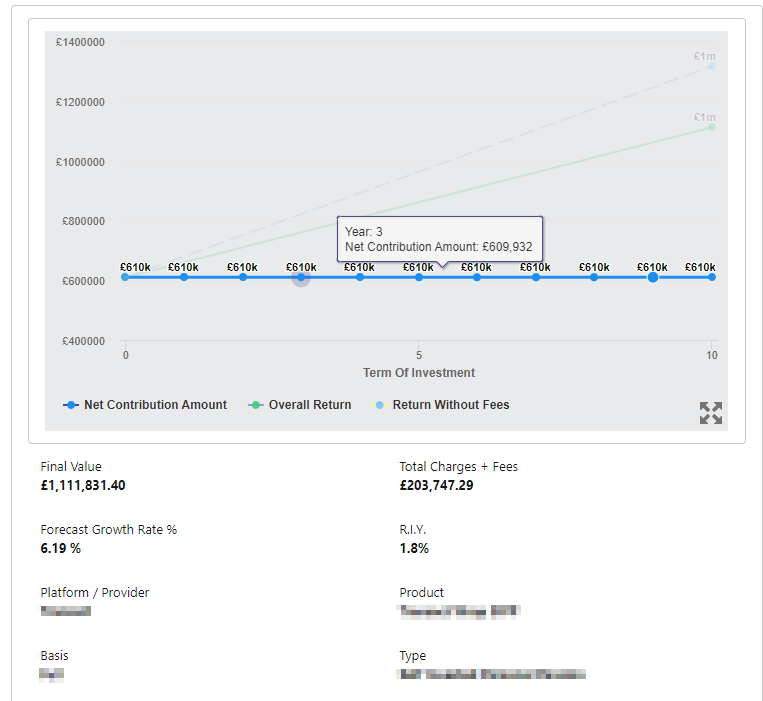

If the Assets Under Management (£571,695.00) are instead added to the initial investment (£38,237.28) making a total investment amount of £609,932.28 the RIY is lower at 1.8% and the (deterministic) forecast growth rate is 6.19%.

When you add the assets under management and initial investment amount and start with a larger initial investment the charges have less of an impact and growth is greater than if the total initial investment amount was only £38,237.28.

While assets under management are used in the calculations to determine the correct charging tiers, the assets under management do not have growth applied in the calculations. When you add assets under management and the amount becomes part of investment amount then growth is applied.