This article explains how to add investments to Comparison & Ex-Ante research, using a Central Investment Proposition. If you have not setup the CIP, this can be done in the Investment Pathways tab. For more information on how to create & build your CIP, see articles here.

Once the Research has been created, you can start to add Investments to Research. See articles on how to create Research - Comparison & Ex-Ante using a CIP- Creating through the homepage, Comparison & Ex-Ante using a CIP - Creating in the research tab or Comparison & Ex-Ante using a CIP - Creating research within a client record

Add investment through the Add Investment + button:

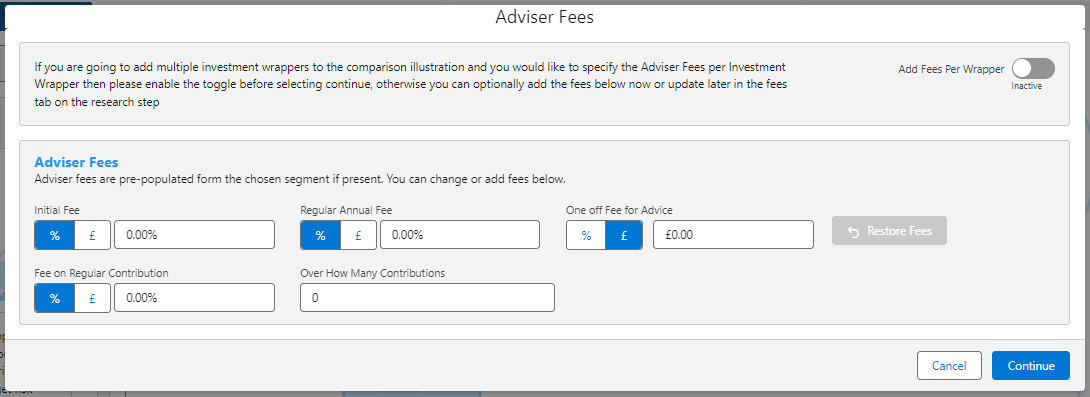

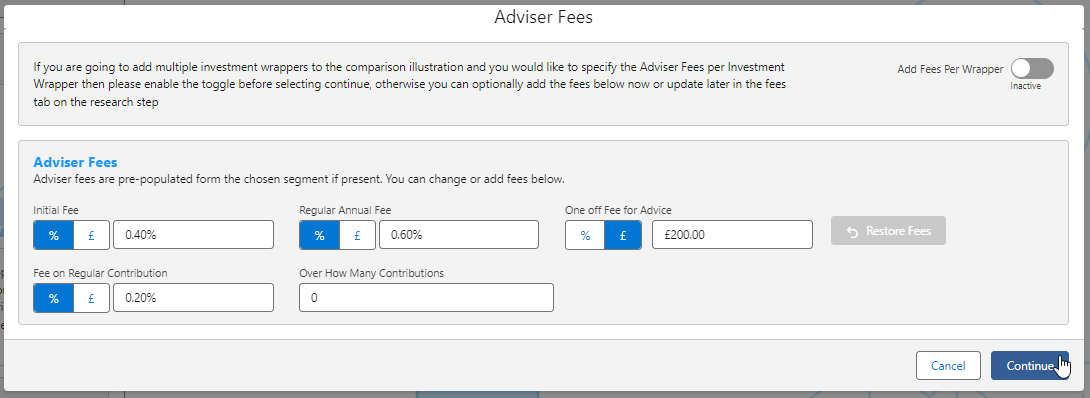

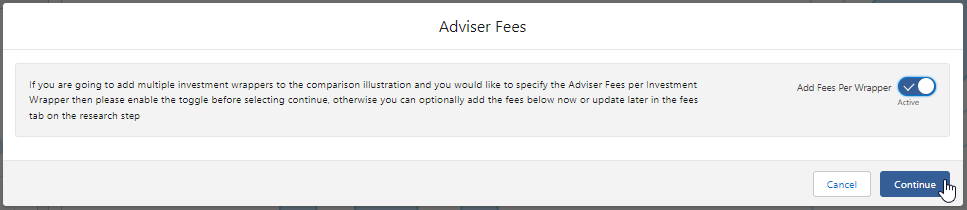

An Adviser Fees box will appear:

If you are going to add multiple investments to the comparison, you can either specify you would like to set fees by individual investment or by research.

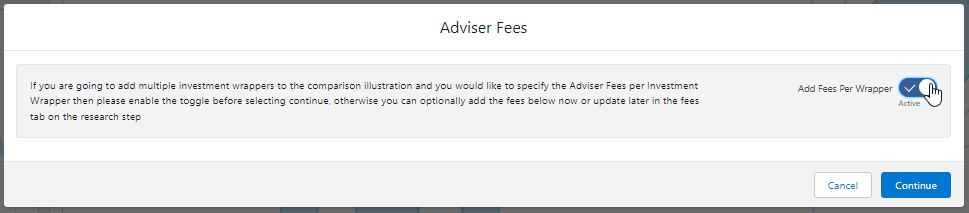

Add Fees Per Wrapper will allow you to enter the adviser fees against the individual investment.

If you would like to apply the fees to the research, enter the details below and Continue.

Note: Fees can be updated in the Fees tab in the research.

For this example, we will add the fees per individual investment.

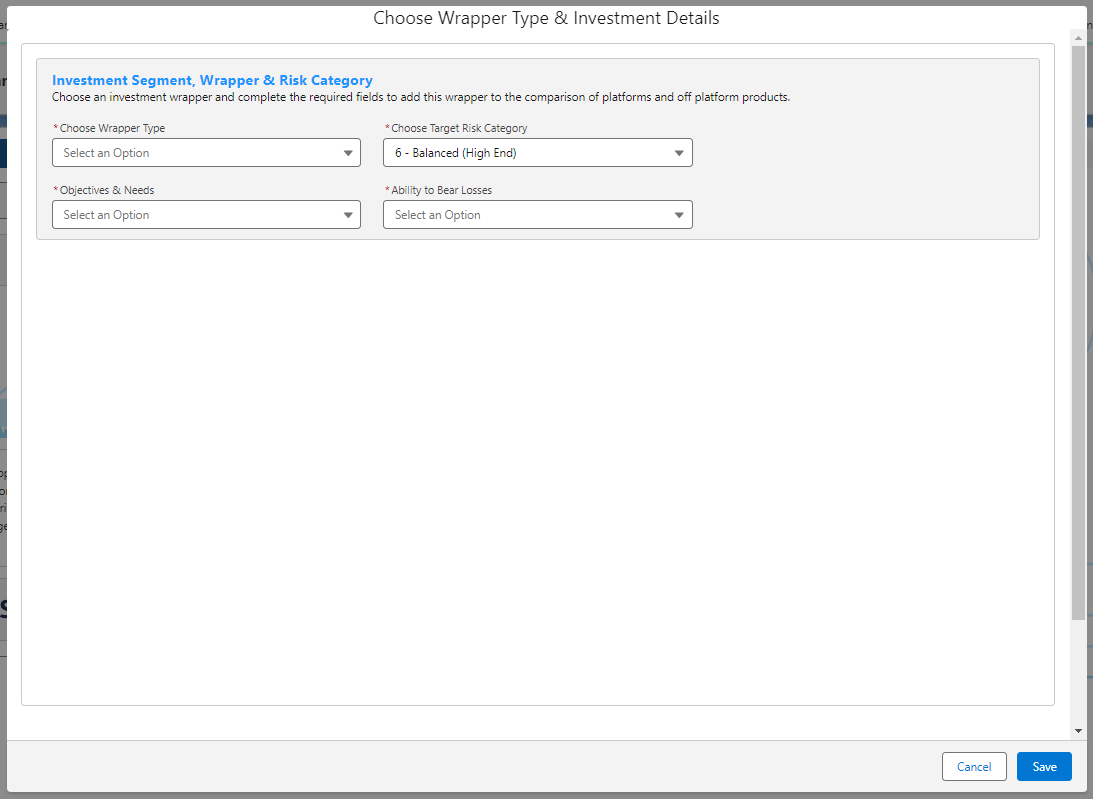

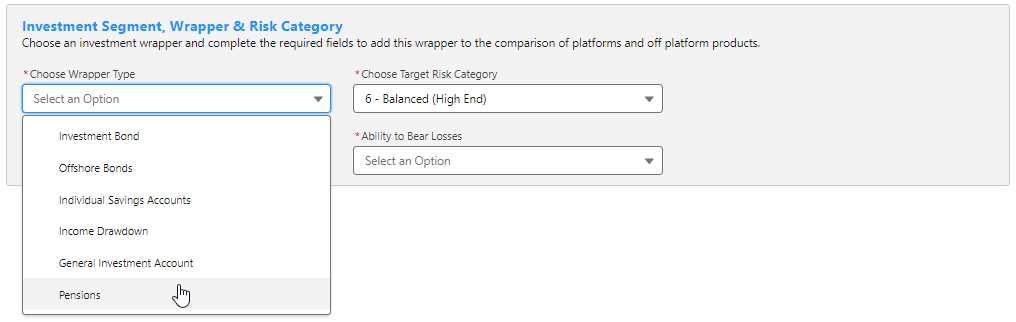

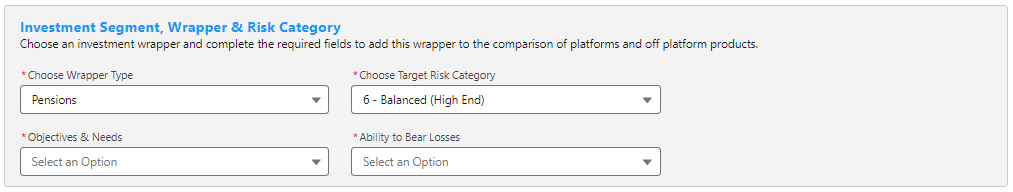

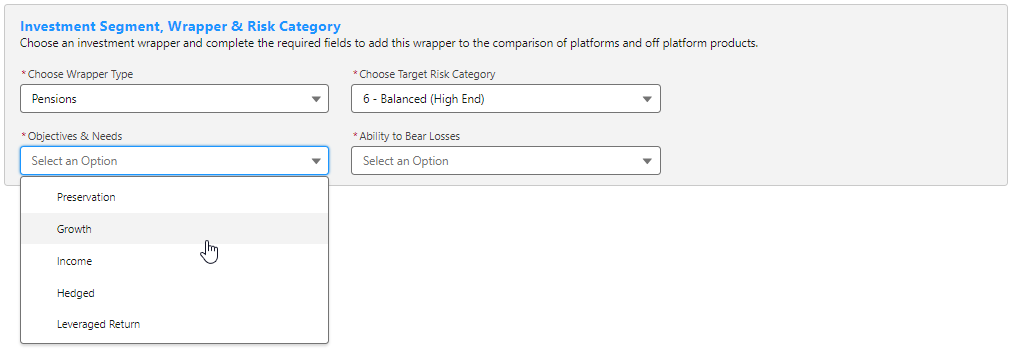

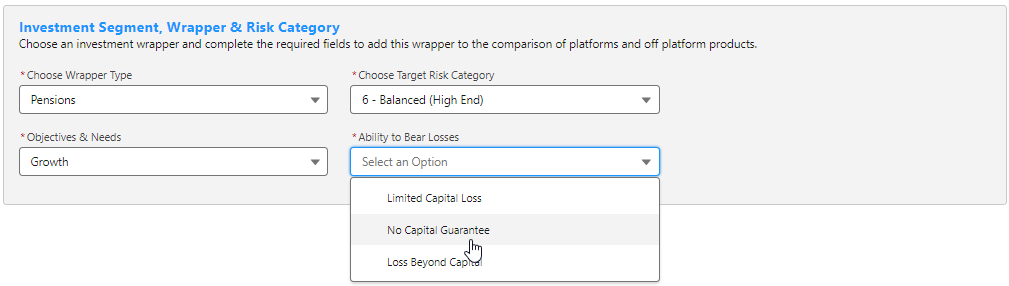

Complete the Wrapper Type, Target Risk Category, Objective & Needs and Ability to Bear Losses:

Target Risk Category will automatically pull through if a attitude to risk questionnaire has been completed and set to default.

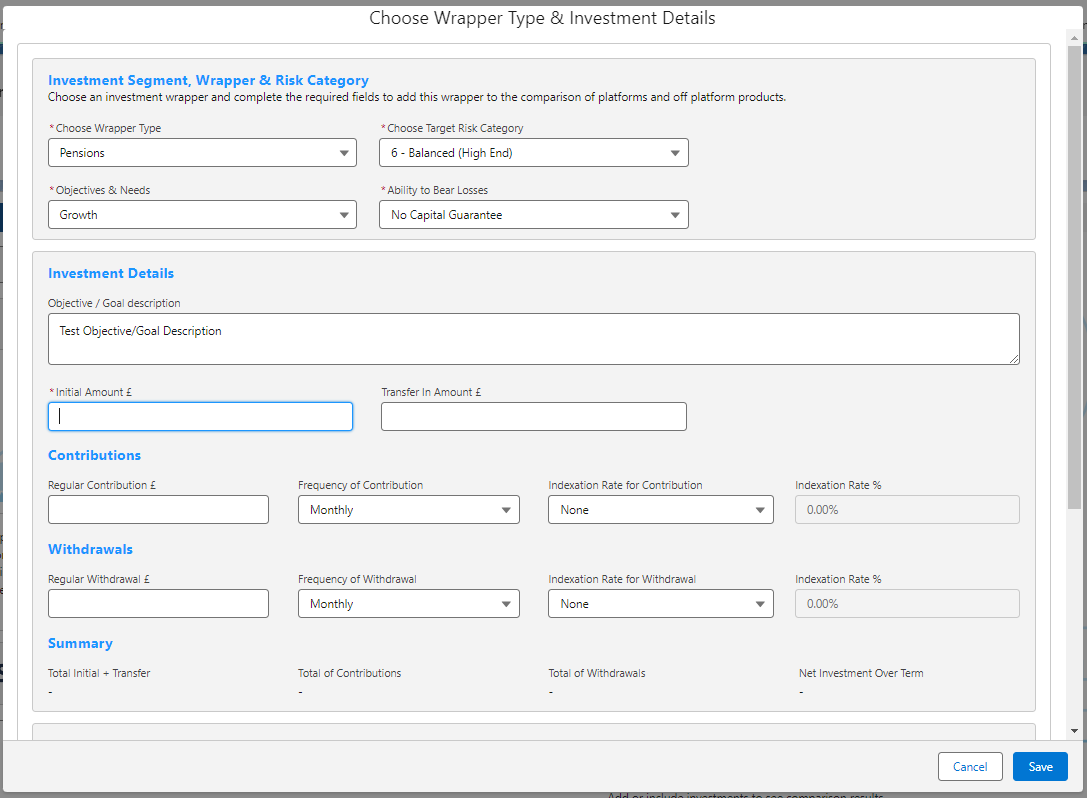

Once all fields have been completed, further detail will appear below:

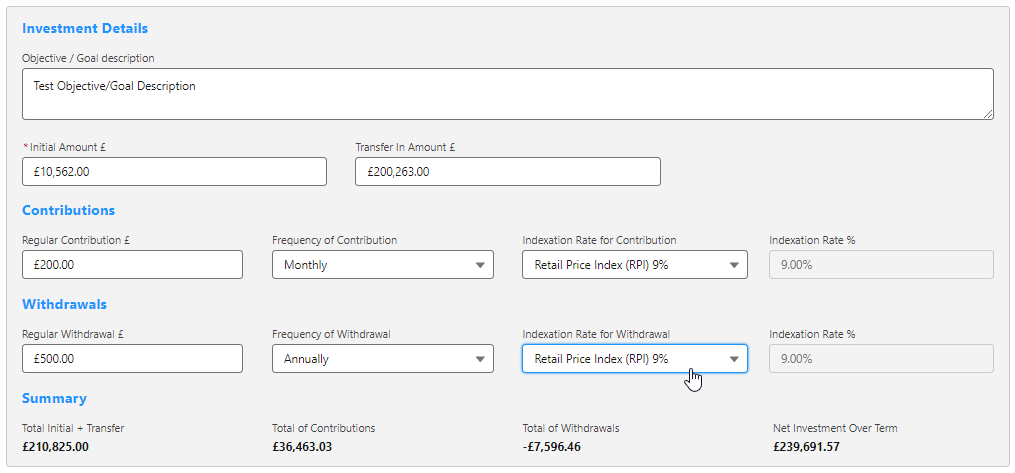

Enter the Investment Details.

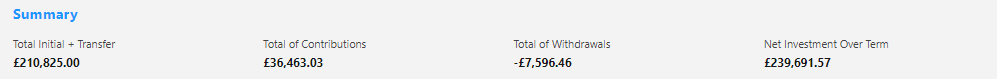

Once entered, a summary will be calculated:

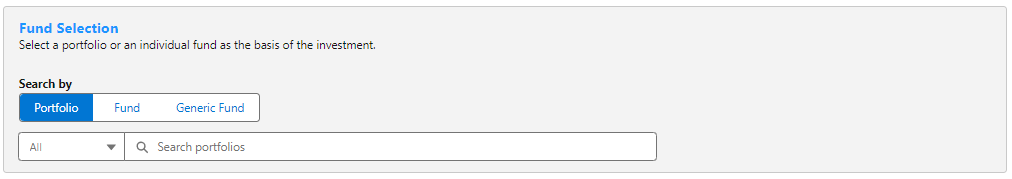

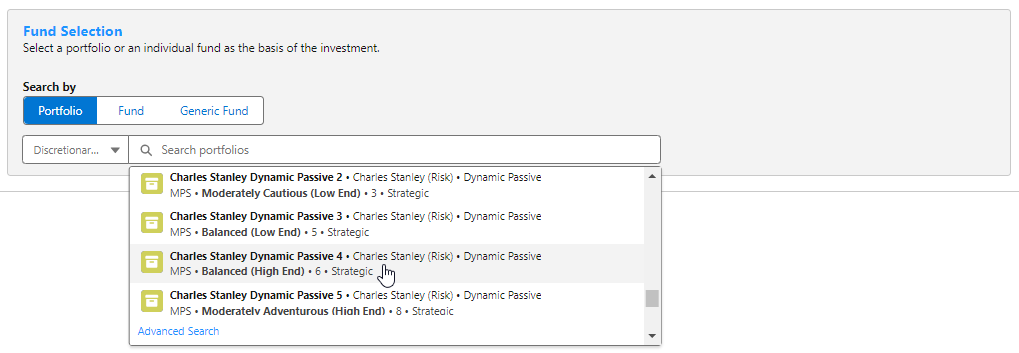

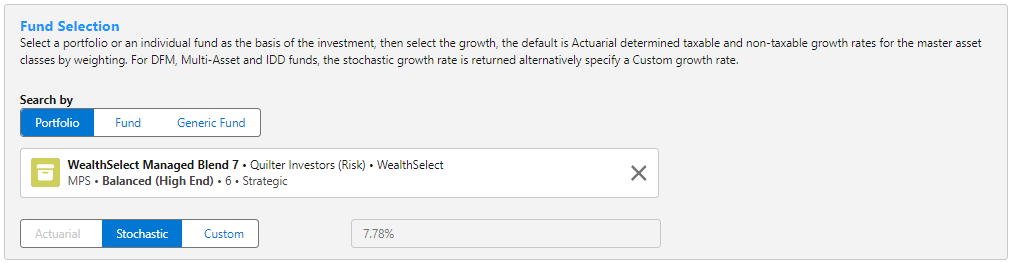

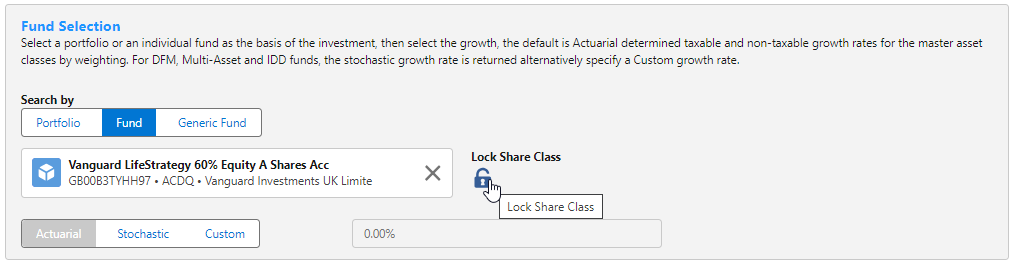

Select the Portfolio, Fund or Generic Fund in the Fund Selection area:

Please note - As we have selected a segment, only funds and portfolios configured in the CIP will be returned. If nothing is returned, check that the fund/portfolio has been added to the CIP and assigned to the chosen segment. See articles Central Investment Proposition - Adding Portfolios, Central Investment Proposition - Adding Fund Lists, Central Investment Proposition - Adding Portfolios to a Segment & Central Investment Proposition - Adding Fund Lists to a Segment.

Choose either Portfolio, Fund or Generic Fund

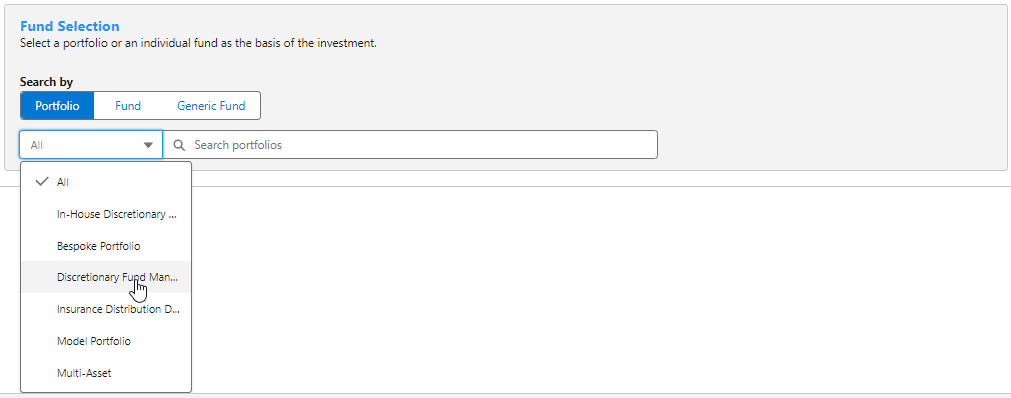

If Portfolio is selected, you are able to select the type of portfolio in the All drop down:

In this example, we have selected Discretionary Fund Managers.

When searching, only Portfolios offered by Discretionary Fund Managers will be returned:

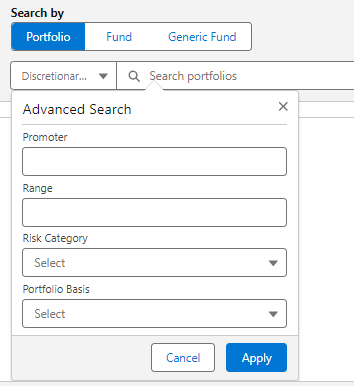

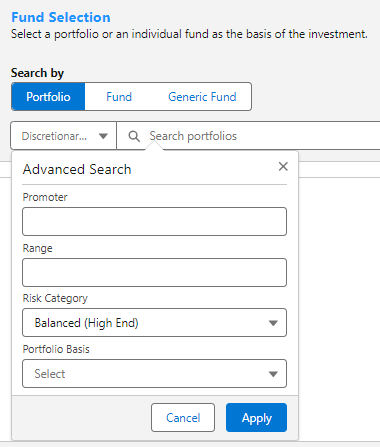

Advanced Search allows you narrow the search by Promoter, Range, Risk Category & Portfolio Basis:

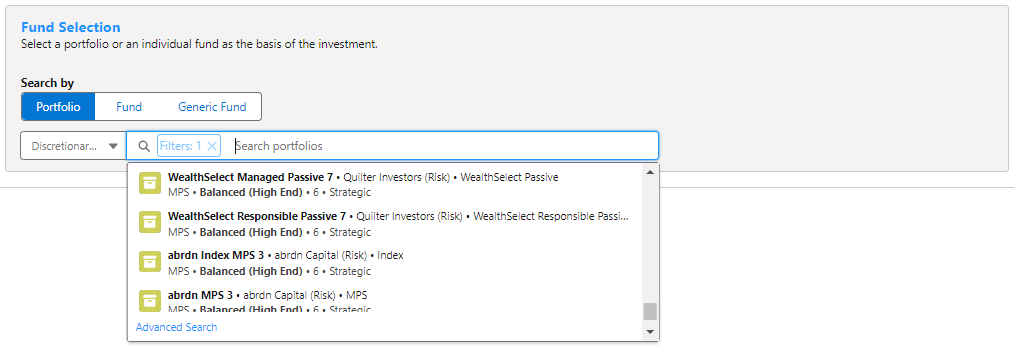

If Risk Category is set, this will return DFM portfolios with a risk rating of Balanced (High End).

Click Apply:

If selecting a fund, click Fund:

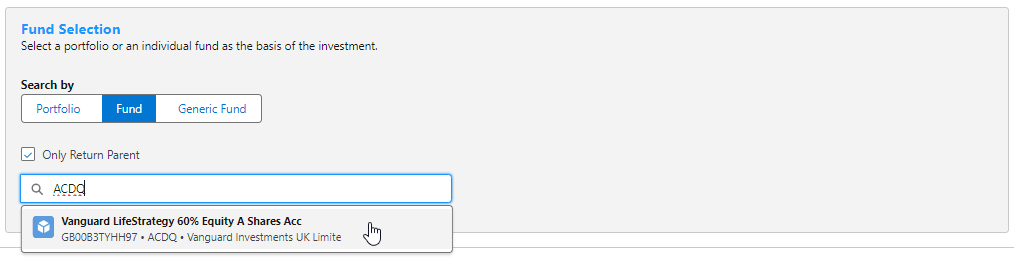

Search for funds using the fund name or fund code. If you would like to return parent only funds, tick the box:

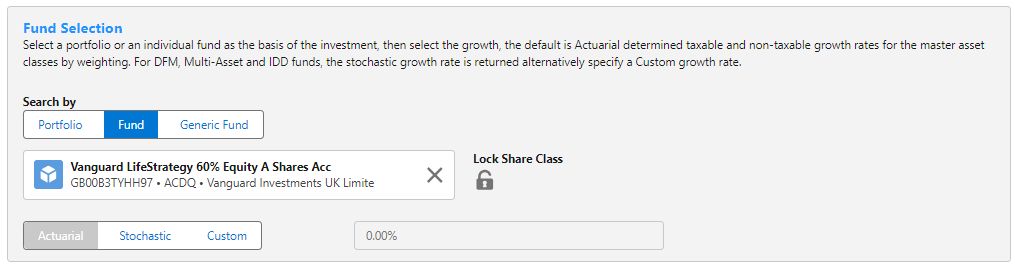

Click the Lock Share Class button if you would like the system to use the exact fund selected. If leaving unselected, the system will find a cheaper version of the fund in the research.

You can set the growth rate. The system will default to Actuarial which is determined taxable and non-taxable growth rates for the master asset class by weighting. For DFM, Multi-Asset and IDD funds, the stochastic growth rate is returned. Alternatively, specify a Custom growth rate:

Click Save:

Once saved, the results will be displayed. Please note - As we have used a Central Investment Proposition and selected a segment, only platforms, off platform products, portfolios and funds configured in the CIP will pull through.