A portfolio is simply a manual fund list for which you have defined holdings – e.g. that 20% of the client’s money is invested in fund A, 30% in fund B, and 50% in fund C.

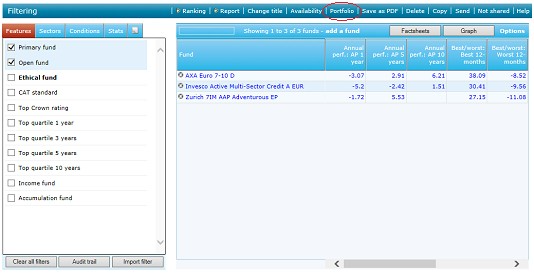

You set these values using the Portfolio link on the menu bar. This is highlighted in the screenshot below, and is only available on manual fund lists. You cannot define holdings in any other type of fund research.

Uses of portfolios

Portfolios have two main uses:

- You can generate portfolio reports showing the performance of each item in the portfolio, and of the whole portfolio compared to a benchmark of your choice.

- You can use portfolios as custom baselines in graphs.

In other words, you can use portfolios as a sort of bespoke benchmark, as well as/instead of a list of funds which you have recommended or are thinking of recommending to a client.

Limits of portfolios

Synaptic Research’s portfolios are not intended to provide true valuations. They are not “transactional” in the sense of letting you record investments starting and ending at a variety of dates.

Instead, Synaptic Research’s portfolios are a guide for sales and review purposes, helping you to assess the potential performance of a portfolio you are thinking of implementing for a client, or of a client’s actual existing portfolio.