Fund research can be ranked in the same way as product research: you click on the Ranking link in the menu bar of the grid page, and then define a ranking scheme.

This is effectively a sophisticated “weighted sort”: you can build league tables of funds based on a combination of different types of indicator such as past performance, charges, risk metrics such as alpha, FE Crown ratings, “desirable” features such as an ethical policy etc. As with product research, all the fields on the Stats tab of the grid are available as ranking items. Therefore, you can rank on things such as fund size (if you prefer larger funds) as well as on performance.

When not to use the ranking system

There’s no need to use the ranking system if you only want a simple list such as the top performer(s) over a single time period. You can generate a list of the top-performing funds over e.g. 5 years by adding this field to the main filtering grid, and then right-clicking on the column header and choosing Sort descending.

In other words, you can “rank” a list of funds on a single field simply by sorting a grid as you would a spread sheet.

Limits on the number of funds displayed in ranking

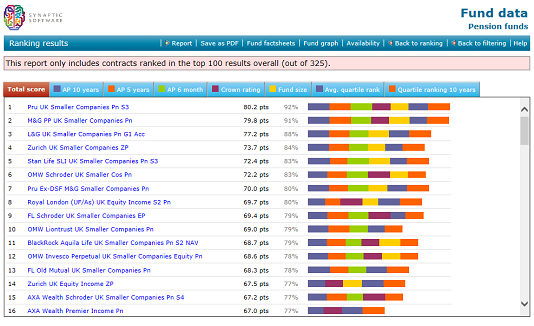

Synaptic Research never displays more than 100 contracts or funds in its ranking results. The screenshot below illustrates the system’s warning if you choose to rank a larger number than this.

The system is still calculating scores for all the funds(all 325 in this example). However, it only displays the top 100 of them on the ranking screen.

Ranking on size, sector correlation, and beta

The following points are also covered in the definitions of the relevant fields. However, it may be useful to note how the system uses fund size, sector correlation, and beta for ranking purposes:

- If you choose to rank on fund size, larger funds are considered better. This is simply on the grounds that larger size broadly indicates greater popularity – and the funds can’t have become popular without doing something right.

- Sector correlation is also treated as good-if-high for ranking purposes. In other words, if you choose to rank on sector correlation then you are effectively saying that you prefer funds whose performance is relatively close to their sector average, and which therefore have relatively low risk of under-performance compared to their peers.

Beta is considered good-if-low for ranking purposes. The assumption is that funds are better if they are less risky than their sectoraverage.